20 Handy Tips For Deciding On AI Stock Analysis Sites

20 Handy Tips For Deciding On AI Stock Analysis Sites

Blog Article

Top 10 Tips To Evaluate The Market Coverage Provided By Ai-Based Stock Predicting/Analyzing Platforms

The market coverage of the trading platforms that use AI analysis and prediction of stocks is crucial, since it defines the markets and assets you can access. With a platform that offers comprehensive coverage, you can diversify your portfolio and make the most of opportunities across the globe. It is also possible to adapt to different trading methods. These are the top 10 tips for evaluating the market coverage offered by these platforms.

1. Evaluate Supported Asset Classes

Stocks: Make sure that the platform includes stocks from all major stock exchanges, which include NYSE, NASDAQ and LSE.

ETFs - Check to see whether your platform can support an extensive selection of ETFs that provide exposure in many different sectors, regions or themes.

Futures and options. Make sure the platform is able to handle derivatives, such as futures, options and other instruments that leverage.

Forex and commodities: Determine if the platform supports forex pairs, precious-metals, agricultural commodities, and energy commodities.

Cryptocurrencies: Check if the platform supports major copyright (e.g., Bitcoin, Ethereum) and altcoins.

2. Check for Coverage Area

Global markets - Ensure that the platform has the capacity to cover all major markets across the world including North America (including Canada), Europe, Asia-Pacific markets as well as emerging ones.

Regional focus: Check whether the platform is focusing on particular market segments or regions which match your trading preferences.

Local exchanges - Examine to find out if there are local or regional exchanges available in relation to your location and strategy.

3. Assessment Real-time against. Delayed Data

Real-time data: Ensure that the platform has real-time market data for timely decision-making, especially for active trading.

Delayed data: Discover whether you are able to get delayed data for free, or at a reduced cost. This may be enough for long-term investors.

Data latency: Make sure the platform reduces latency of real-time feeds. This is especially important for traders with high frequency.

4. Evaluation of Data from the Past

Depth of historic data Check that the platform has ample data (e.g. over 10 years old) to backtest.

Review the accuracy of historical data.

Corporate actions: Verify that historical data takes into account splits in stock (if applicable), dividends and other corporate action.

5. Examine the Order Book and Market Depth Information

Data Level 2: Ensure the platform offers Level 2 (order book depth), for better price discovery.

Spreads of bids: Make sure that the platform is displaying real-time bid spreads for accurate pricing.

Volume data - Verify whether the platform contains extensive volume data to analyze market activity and liquidity.

6. Review the coverage for Indices and Sectors

Major indices - Make sure your platform works with the major indices such as S&P 500 and FTSE 100 for benchmarking.

Data from specific sectors for focused analysis, determine if the platform has data for certain sectors (e.g. technology, health care, technology, etc.).

Custom-made indices. Check if you can build or monitor custom indices using your criteria.

7. Evaluation of integration with News and Sentiment data

News feeds : Make sure you use a platform that incorporates live news feeds, particularly from reputable media sources (e.g. Bloomberg and Reuters) to cover the most significant market events.

Sentiment analysis: Find out whether the platform offers sentiment analysis tools that are based on social media, news, or other data sources.

Strategies that are based on events (e.g. earnings announcements or economic reports) Verify if your platform allows trading strategies that rely on events.

8. Verify Multi-Market Trading Capability

Cross-markets trading: The platform should allow trading in different asset classes or markets through a single interface for users.

Currency conversion: Confirm that the platform supports multicurrency accounts and currency conversions for international trading.

Time zone support: Determine whether the trading platform is compatible with different timezones for global markets.

9. Examine coverage of alternative data sources

Look for other data sources.

ESG Data Look to determine if there are any data on the environment, social or governance (ESG data) on the platform for investing socially responsible.

Macroeconomic data - Ensure that the platform is equipped with macroeconomic data (e.g. inflation, GDP) to conduct fundamental analysis.

Review Feedback from Customers and Market Reputation

User reviews: Research feedback from users to determine the coverage of the platform's market and quality of service.

Reputation of the industry Know whether there are awards or experts who recognize the platform's coverage of the market.

Find testimonials that prove the platform's efficiency in specific assets and markets.

Bonus Tips

Trial period: Try the demo or trial version for free to test the platform's market coverage and data quality.

API access - Determine if the API can be used to access data on the market in a programmatic manner.

Support for customers: Make sure the platform provides support for market-related queries or issues with data.

By using these tips, it is possible to be able to accurately evaluate the coverage of AI stock prediction/analyzing trading platform. You can then choose an investment platform that provides you the markets and necessary information to be successful in your trades. Market coverage that is comprehensive will enable you to diversify, explore the market, and adjust your portfolio to new market conditions. View the best AI stock picker examples for website tips including ai investment platform, ai trading tools, ai investment platform, AI stock, AI stock trading app, ai trading, stock ai, ai investing, ai for stock predictions, AI stocks and more.

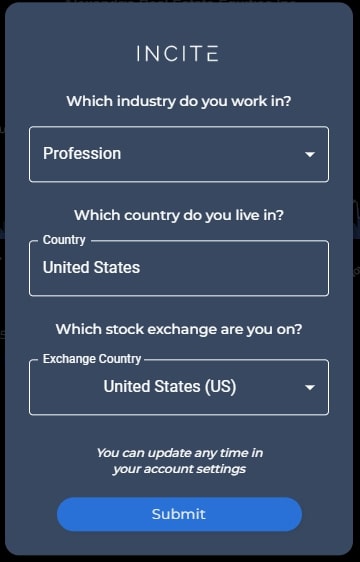

Top 10 Tips On Assessing The Trial And Flexibility Of Ai Platform For Analyzing And Predicting Stocks

It is crucial to assess the flexibility and trial capabilities of AI-driven stock prediction and trading systems before you sign up for a subscription. These are the top 10 tips to consider these factors:

1. Try it out for free

Tips Check to see whether a platform offers a free trial that you can use to experience the features.

The reason: The trial is an excellent opportunity to try the platform and assess the benefits without risking any money.

2. Limitations on the time of the trial

TIP: Make sure to check the validity and duration of the trial (e.g. restrictions on features or access to data).

The reason: Knowing the constraints of a trial can help you decide if it provides a comprehensive evaluation.

3. No-Credit-Card Trials

Look for trials which do not require credit card upfront.

Why this is important: It reduces any possibility of unanticipated charges and makes the decision to leave simpler.

4. Flexible Subscription Plans

Tip: Evaluate if the platform offers flexible subscription plans (e.g., monthly, quarterly, or annual) with clear pricing tiers.

Flexible Plans permit you to pick a level of commitment that is suitable for your needs.

5. Features that can be customized

Find out if you can customize options like alerts or risk levels.

The reason is that customization allows the platform’s adaptation to your particular requirements and preferences in terms of trading.

6. It is easy to cancel a reservation

Tip: Determine how simple it is to cancel, downgrade, or upgrade a subscription.

Why: By allowing you to leave without hassle, you'll avoid getting stuck in the wrong plan for you.

7. Money-Back Guarantee

Tip: Search for platforms that offer a guarantee of refund within a set period.

Why? This is another security step in the event your platform does not live up to the expectations you set for it.

8. Access to Full Features During Trial

TIP: Make sure the trial offers access to the main features.

You can make an informed choice by evaluating the whole functionality.

9. Support for customers during trial

Tips: Examine the level of support offered by the business throughout the trial.

The reason: A reliable support team ensures you can resolve issues and make the most of your trial experience.

10. Feedback Mechanism Post-Trial Mechanism

Make sure to check the feedback received after the trial period in order to improve the quality of service.

What's the reason? A platform that relies on user feedback is bound to develop more quickly and better cater to users' needs.

Bonus Tip Optional Scalability

As you increase your trading activity and you are able to increase your trading volume, you might need to modify your plan or add more features.

Before you make any financial commitment take the time to review these options for flexibility and trial to determine if AI stock prediction and trading platforms are the most appropriate for you. View the recommended continue reading this for more tips including can ai predict stock market, best AI stocks to buy now, AI stock prediction, can ai predict stock market, chart ai trading, free ai tool for stock market india, ai for trading stocks, stock trading ai, chart analysis ai, how to use ai for stock trading and more.